By P&PC Staff –

The overall outlook for the global paper, packaging and forest products industry has been changed to positive from negative, reports Moody’s Investors Service.

The change to a positive outlook for the industry is driven by expectations that the consolidated operating income of the 41 paper and forest product companies rated by Moody’s globally will increase by six per cent to eight per cent over the next 12 months.

By region, Moody’s says that the consolidated operating income from rated producers in North America and Latin America is anticipated to increase 12 per cent and nine per cent, respectively, even as the consolidated operating income from rated producers in Europe will decline.

This is primarily driven by the flow-through of current peak North American prices for most wood products, as well as the rating agency analysts’ expectation of modestly higher global market pulp prices.https://312f0f64dee1e0b7e079b307be6870c1.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

“We anticipate demand for most paper and forest product grades will increase in 2021 as the global economy emerges from the coronavirus recession,” says Ed Sustar, a Moody’s senior vice-president, in a statement.

Timber and wood products

The outlook for the timber and wood products sub-sector has changed to positive from negative as well, with operating earnings of Moody’s nine rated companies primarily driven by timberland or wood product operations increasing about eight per cent over the next 12 months.

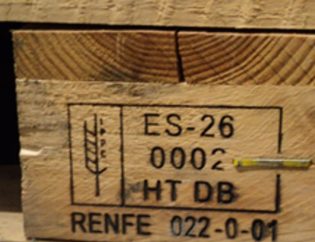

The outlook change for the timber and wood products sub-sector is buoyed by the flow through of considerably higher-than-normal North American lumber and oriented strandboard (OSB) prices after significant restrictions by producers removed too much capacity from the market at the start of the pandemic.

This curtailment caused significant product shortages as demand surged, fueled both by do-it-yourselfers building decks and fences during lockdowns and higher-than-anticipated residential home construction demand.

Even so, lumber and OSB prices are expected to come off their peak levels in the fourth quarter but remain elevated due to limited supplies in the North American market, according to Sustar.

Pulp

Moody’s outlook for the market pulp sub-sector has changed to positive from negative, with operating earnings of the eight rated pulp products companies increasing about eight per cent over the next 12 months.

Meanwhile, prices for most grades of pulp are anticipated to similarly increase by about eight per cent from current near trough levels over the next year, as limited new near-term capacity growth, anticipated supply disruptions with higher-than-normal second half 2020 maintenance downtime and increased pulp demand will likely allow market pulp inventory levels and prices to improve in 2021.

Further buoying pulp prices is the shift by Chinese paper producers to increasingly rely on market pulp, as China continues to phase out imported recycled fibre due to stricter environmental regulations.

Paper packaging and tissue

The outlook for the paper packaging and tissue sub-sector is negative, with operating earnings of the 14 rated companies that are primarily driven by paper packaging and tissue operations declining by about two per cent over the next 12 months.

Following a surge in paper packaging and tissue demand as consumers loaded their pantries amid the pandemic, Sustar says demand will slow for the balance of the year.

Nevertheless, the loss of demand from non-essential segments of the economy, such as restaurants and sporting events, has essentially been offset by higher e-commerce demand.

At-home consumption trends brought about by the pandemic have also helped to keep paperboard markets in balance, while stronger retail tissue demand has been partially offset by weaker away-from-home tissue consumption. Tissue demand is expected to normalize in the second half of the year as consumers look to use what’s in their pantries rather than buy additional products.

Printing and writing paper

Similarly, the outlook for the printing and writing paper sub-sector remains negative as demand remains weak with many schools and office buildings still closed.

And for the 10 rated companies primarily driven by their printing and writing paper operations, operating earnings are expected to decline about 12 per cent over the next 12 months.

Partially offsetting this decline, however, is the increased demand for paper books, for both educational and entertainment needs, for consumers stuck at home, even as the increased reliance on digital technologies, like electronic storage and e-books, will likely persist to some degree post-pandemic.